Deceased Estates

Administering a probate estate in Michigan is a detailed and often complex process. Personal representatives have multiple responsibilities and requirements, some of which are time sensitive. Mistakes in probate administration can result in delays and potential personal liability. Therefore, personal representatives are strongly advised to seek legal guidance from an experienced probate attorney to ensure compliance with Michigan law and to navigate potential challenges during the administration of the estate.

Probate estate administration is the legal process through which a deceased person’s estate is administered and distributed.

The primary goals of probate are to settle the decedent's debts, ensure the proper distribution of assets, and handle any disputes that may arise. The process of administering a probate estate is detailed in Michigan’s Estates and Protected Individuals Code.

Powers and Duties of a Personal Representative

Initiate Probate Process: The personal representative initiates the probate process by filing an application or petition with the probate court in the county where the decedent resided or owned property.

Notice to Interested Parties: The personal representative must provide notice to interested parties, including heirs, devisees, bonding companies, creditors, and any other individuals or entities with a legal interest in the estate.

Publication for Creditors: The Personal Representative is typically required to publish notice to creditors in a local legal newspaper, allowing them an opportunity to file claims against the estate before the deadline.

Inventory of Assets: The personal representative is responsible for preparing a comprehensive inventory of the decedent's assets. This includes real property, personal property, financial accounts, and any other assets.

Manage Estate: The personal representative collects and manages the decedent's assets during the probate process. This may involve accessing bank accounts, selling real estate, and taking control of other property.

Continue Business Affairs: MCL 700.3715 grants the personal representative the authority to continue the decedent's business. This may involve making decisions to sustain or wind down the business.

Pay Debts and Expenses: The personal representative must identify and pay the decedent's outstanding debts and expenses. This may involve working with creditors to settle claims.

Resolve Creditor and Legal Disputes: The personal representative is tasked with resolving and creditor claims or legal disputes that arise against the estate.

Assest Distribution: The personal representative distributes remaining assets according to the decedent's will or, if there is no will, according to Michigan's intestate succession laws.

Accounting and Reporting: The personal representative is required to keep accurate records of all financial transactions related to the estate.

Closing the Estate: Once all tasks are completed, the personal representative files a final accounting with the court.

Approval for Certain Actions: The personal representative may need court approval for certain actions, such as the sale of real estate or abandoning property.

Wayne County Probate Court

1305 Coleman A. Young Municipal Center

Two Woodward Avenue

Detroit, Michigan 48226

(313) 224-5706

probateservice@wcpc.us

Monroe County Probate Court

125 East Second Street Monroe,

Michigan 48161-2197

(734) 240-7000

probateclerks@monroemi.org

Oakland County Probate Court

1200 N. Telegraph Road

Pontiac, MI 48341

(248) 858-1000

ProbateDE@Oakgov.com

FAQs about Deceased Estates in Michigan

What is probate, and when is it necessary?

Probate is a legal process that involves administering the estate of a deceased individual. It is necessary when there are assets solely owned by the decedent that need to be transferred to heirs or beneficiaries after they pass.

What is the role of a personal representative?

A personal representative is appointed by the court to administer the estate. Their role includes gathering assets, paying debts, distributing assets to beneficiaries, and managing the probate process.

How is probate initiated in Michigan?

The probate process is initiated by filing of an application or a petition for a hearing before the probate court in the county where the decedent lived or owned property. The court then appoints a personal representative to oversee the estate administration.

What assets go through probate?

Assets that are solely owned by the decedent and do not have designated beneficiaries may go through probate. This includes real estate, bank accounts, and personal property. Certain assets, such as those with designated beneficiaries, may bypass probate. However, probate may be necessary to transfer other assets and or pay creditors of the estate.

How long does the probate process take in Michigan?

The duration of probate can vary depending on the issues in each estate, but it typically takes from five months to a year to complete. Complex estates or legal challenges can extend that estimated timeline.

Can a deceased person's Will be contested?

Yes, interested parties can contest a will in Michigan. Common reasons include claims of undue influence, lack of capacity, or fraud.

What happens if there is no will in Michigan?

If there is no will, the estate is distributed according to Michigan's intestate succession laws, which determine the distribution of assets among heirs. This typically involves the distribution of the estate assets to any surviving spouses, children, parents, siblings, or alike.

How are debts handled in Michigan probate?

The personal representative is responsible for publishing notice to creditors, identifying any potential creditors, reviewing creditor claims, and paying the decedent's debts and expenses using estate funds. Personal representatives should be careful not to pay any estate creditor without first determining if there will be sufficient estate assets to cover all potential claims.

What fees are involved in Michigan probate?

Probate costs may include court filing fees, inventory fees, publication costs, attorney fees, and fees for appraisers or other professionals involved in the estate administration.

Can I serve as the personal representative?

The court will give priority of appointment to the decedent’s named personal representative, or their surviving spouse or close relatives. However, any competent adult can potentially serve as a personal representative.

Please note that this FAQ is intended as a general guideline and should not be considered legal advice. If you have specific questions or need legal assistance related to decedent estates, it is advisable to consult with an experienced attorney who specializes in probate matters.

-

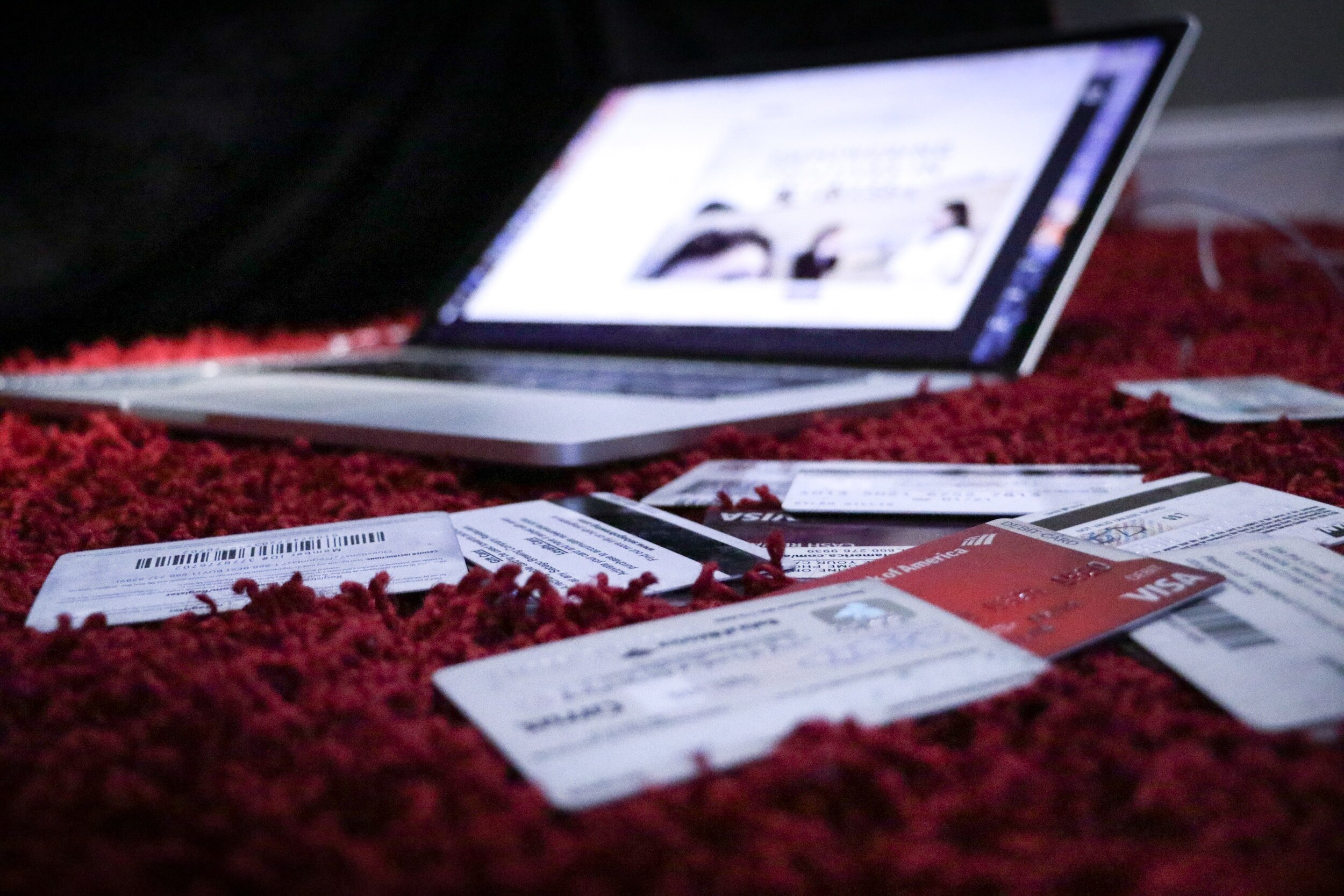

Creditor Claims in a Probate Estate: Do They Have to Be Paid?

Michigan, like many other states, has specific laws governing creditor claims in probate estates. In this blog post, we'll delve into the legal aspects of creditor claims in Michigan probate estates and explore whether these claims are required to be paid, referencing relevant statutes such as MCL 700.3801, MCL 700.3806, and MCL 700.3805.

-

Michigan Probate Costs and Fees: Managing Estate Expenses

Probate fees can impact distribution of assets and the compensation to beneficiaries. Additionally, some costs might be due prior to having access to estate funds. In this blog post, we'll break down the key fees you can expect during a Michigan probate estate administration.

-

Selling Real Estate from a Decedent's Estate in Michigan: A Guide

Michigan provides guidelines for personal representatives seeking to sell real estate. In this legal blog post, we'll explore the authority of a personal representative to sell real estate under MCL 700.3715 and the process of filing a Petition for Approval for the Sale, utilizing the State of Michigan's form (PC 681).